For the best part of 200 years, Companies House has acted as the formal register of all companies in the UK.

What exactly does that mean? In a nutshell, Companies House makes the information contained on that register available to a wide range of users including companies, investors, researchers, credit reference agencies and government departments, as well as the general public. Those users can then make important decisions based on that information, including ones that encourage economic growth.

However, there’s another side to Companies House, one that not everybody sees or is aware of. That’s the part it plays in combatting economic crime.

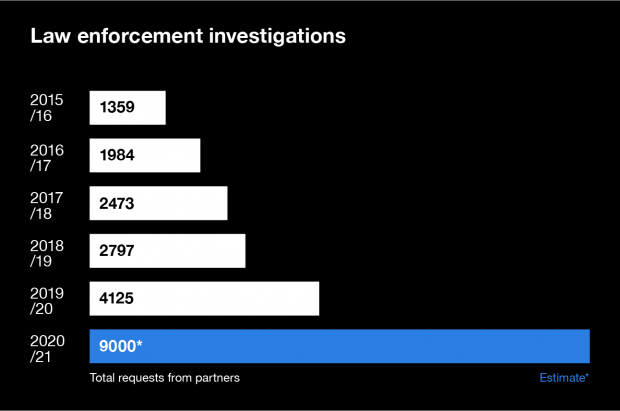

There was a time, not so long ago, when the number of law enforcement investigations involving Companies House stood in single digits per month. Today, that number has soared to approximately 9,000 per year, largely because of improved relationships with law enforcement partners and working to provide valuable intelligence for often complex and wide-ranging criminal investigations.

The chart shows the total number of requests from law enforcement partners from 2015/16 to 2020/21.

In 2015/16 there were 1359 requests, in 2016/17 there were 1984 requests. In 2018/19 there were 2,473 requests, in 2018/19 there were 2,797 requests, in 2019/20 there were 4,125 requests and in 2020/21 there were an estimated 9,000 requests.

For some time, there have been calls for Companies House to play an even greater role in bringing down the criminals involved in a wide range of illegality, including:

- fraud

- bribery

- corruption

- money laundering

- financing of terrorism

But for that to happen, large-scale reform is necessary. Which is where the Economic Crime Plan and the government’s Corporate Transparency and Register Reform legislation come in.

The Economic Crime Plan represents a step-change in the government’s response to economic crime and the threats that it poses. It acknowledges the need for a multi-agency approach from across the public and private sectors to combat its ever-evolving, secret nature.

Collectively, the actions in the plan form a whole-system approach to tackling economic crime. A greater understanding of the threat and improved transparency of ownership, together with better sharing and usage of information, will allow the public and private sectors to target their resources more efficiently and effectively. And, when criminal activity is identified, there will be powers and capabilities to bring the offenders to justice, sending out the message that crime does not pay.

Those powers to challenge people when we either see suspicious activity or queries are raised with us cannot come soon enough, because we are bursting with enthusiasm to undertake the broader role that government wants us to do.

When you talk to people within the Home Office, which co-owns the Economic Crime Plan along with the Treasury, their view is that Companies House is critical to tackling what they refer to as the ‘economic crime ecosystem’. We’re very much front and central to that.

We already support thousands of investigations each year involving law enforcement partners. We collaborate across government and share data. We are very much involved now.

What we do not have are the tools to prevent a lot of the misuse of corporate entities that we see. That’s what reform will give us. Something as straightforward as verifying the identities of people looking to set up companies would prevent a lot of criminal activity from occurring.

It almost goes without saying that the overwhelming majority of the UK’s 4.6 million registered companies are law-abiding and used entirely for legitimate purposes.

However, the misuse of some legal entities in recent years – the Azerbaijani laundromat money laundering scandal, for example – has shown how criminals use complex corporate structures to hide their involvement in illegal activity.

If implemented in full, the proposals within the plan will give Companies House greater legal powers to:

- query and seek verification on information that’s submitted to it

- amend and update errors on its register

- work more closely with law enforcement and other partners to support investigations into those engaging in illicit activities

Investing in, and developing, technological solutions to improve automated checks on that information will also play an important role in the post-reform Companies House of the future.

When I first joined Companies House, it was explained to me by a colleague that company law is a bit like a pendulum. It swings between making it as easy as possible for people to do business, to moving the other way where it’s far more controlled and scrutinised. We’re trying to strike a balance somewhere in between.

This is an area where Companies House has real ambition. We’re currently talking to lots of different parts of government as we seek to clarify our place in this new-look, post-reform world. We can see the absolutely crucial role that we can play, which is why we’ve made this one of our own internal strategic goals.

We’ve played an active part in trying to tackle criminal activity and economic crime. But, to play the full part, we needed this reform. That’s why we’re fully supportive of government and what they want to achieve in this area.

Our 5-year strategy details a new vision for Companies House and outlines our commitment to driving confidence in the UK economy.

Read more about how we're helping to make the UK a great place to start and run a business.

4 comments

Comment by Harry Campbell Bernhar Ltd posted on

Introduction of a check system for people to check that taxes paid on legal transactions are received by HMRC. A check system for example that the Accountancy profession could check the legal profession tax generating transactions are received by HMRC. Presently the legal profession has the option of recording transactions or NOT recording transactions that generate Taxes. We welcome these reforms.

Comment by Harry Campbell Bernhar Ltd posted on

Consider a check system to follow taxes paid are received by HMRC

Comment by Potentially Vulnerable posted on

I fully support the measures to combat economic crime, unfortunately some Companies House practices also facilitate economic crime. The publishing of Director’s dates of birth and signatures assists identity theft. My strenuous efforts to safeguard my personal information are all undermined by the publishing of private information which I am legally obliged to supply. I am obliged to use a pseudonym for this post because otherwise it steers those of evil intent to my Director’s listing

Comment by jodiejohn posted on

Hello, thanks for your comment.

A new director must provide their full date of birth on appointment, but this is held on a private register. Only the month and year of birth will be publicly available. The full date of birth is only disclosed in exceptional circumstances. For example, to credit reference agencies or to the police.

There are also laws to help a director protect their home address on the public register, or remove it from publicly available documents: https://www.gov.uk/government/news/new-laws-to-protect-your-home-address-at-companies-house

Options for further protection are also available for those at risk of violence or intimidation: https://www.gov.uk/stop-companies-house-from-publishing-your-address

There was also a recent consultation exploring how the registrar's powers could be strengthened in a range of areas, including amending or removing information from the companies register: https://www.gov.uk/government/consultations/corporate-transparency-and-register-reform-powers-of-the-registrar